See the company’s PREC14A here, and a subsequent DEFA14A (where they provide a synopsis of the board’s recent efforts) here.

The well-documented opponents:

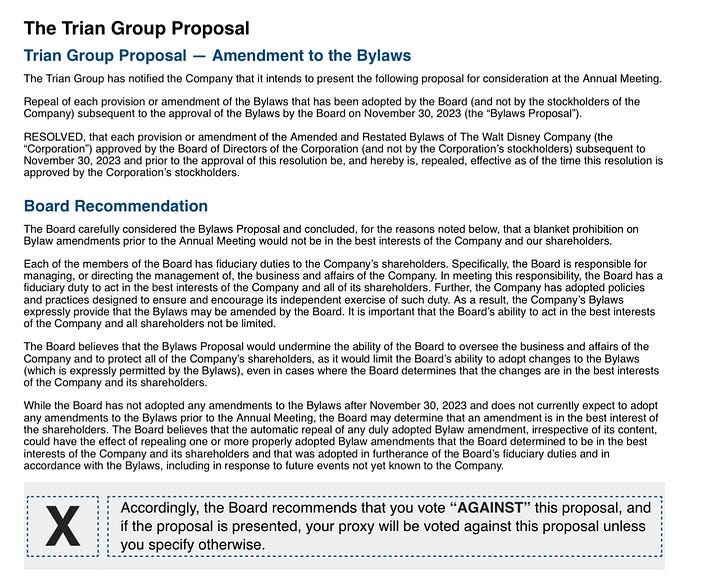

The Board does not endorse the nominations of Nelson Peltz and James Rasulo put forth by Trian Fund Management, L.P. and its affiliates, led by Nelson Peltz and supported by former Disney executive Isaac Perlmutter (collectively, the “Trian Group”). The Board recommends that shareholders do not vote for the Trian Group nominees, and that they reject a related proposal from the Trian Group to amend the Company Bylaws.

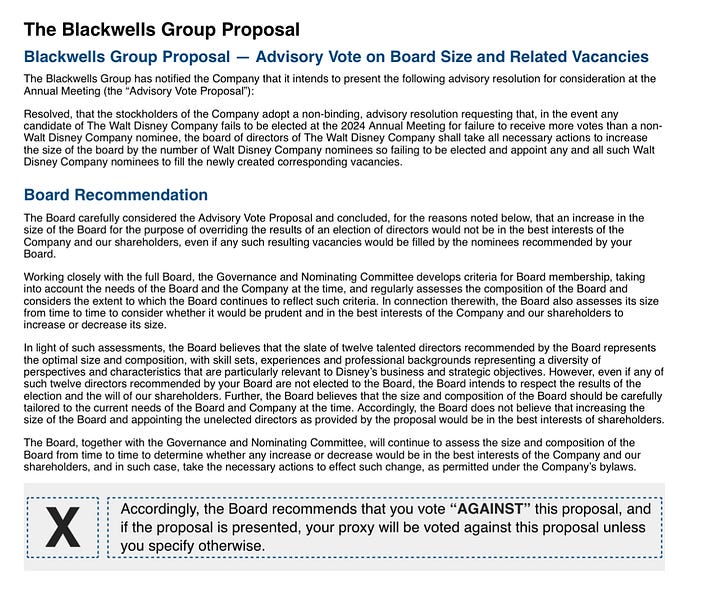

Separately, the Board does not endorse the nominations of Craig Hatkoff, Jessica Schell and Leah Solivan put forth for election as directors by Blackwells Onshore I LLC, Blackwells Capital LLC and Jason Aintabi (collectively, the “Blackwells Group”), and recommends that shareholders not vote for the Blackwells Group nominees. The Board also recommends shareholders reject a related proposal from the Blackwells Group.

Disney proffers “four key building opportunities that will be central to [their] success”

First is achieving significant and sustained profitability in streaming. Over the past fiscal year, we have reset this business around economics designed to deliver on this goal, and we believe we are well on the path toward making it a reality. We are rationalizing the volume of content we make and what we spend; perfecting our pricing and marketing strategies; maximizing our enormous advertising potential; and moving toward a more unified one-app experience by making extensive Hulu content available to bundle subscribers via Disney+.

Next is taking ESPN – already the world’s leading sports media brand – and turning it into the preeminent digital sports platform. There is tremendous value in sports, demonstrated by the immense popularity of ESPN’s programming and its growth in both revenue and operating income for the past two fiscal years amidst a backdrop of notable linear industry declines. Today, we are preparing ESPN for a future in streaming that will further harness the power of live sports and entertainment in innovative new ways.

The third building priority is improving the output and economics of our film studios, which produce the content and intellectual property that generate value across the entire company. We are focusing heavily on the core brands and franchises that fuel all our businesses, and reducing output overall to enable us to concentrate on fewer projects and improve quality, all while continuing our effort around the creation of fresh and compelling original IP.

Finally, we are turbocharging growth in our Experiences business, including Domestic and International Parks and our Cruise Line. Historically, investments in this business have yielded attractive returns for shareholders. Given our wealth of stories and characters, innovative technology, buildable land and unmatched creativity, we are confident about the growth potential of our new investments.

Disney’s event timeline with Trian & Blackwells:

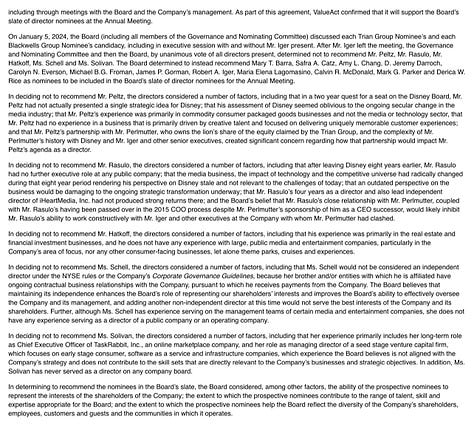

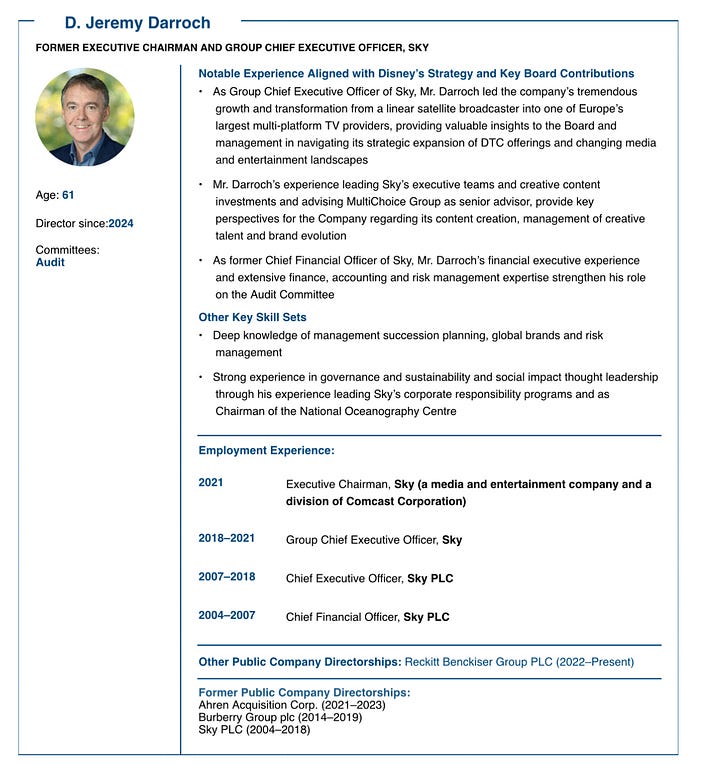

The two recent additions to the board:

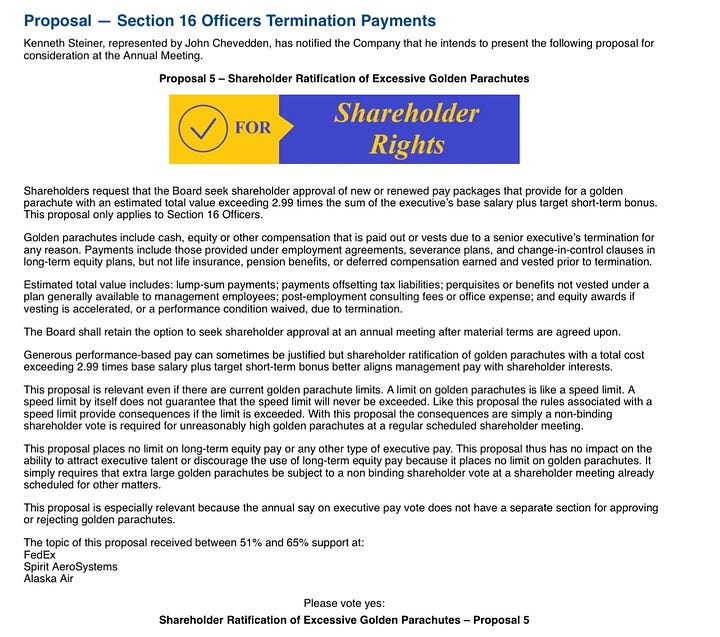

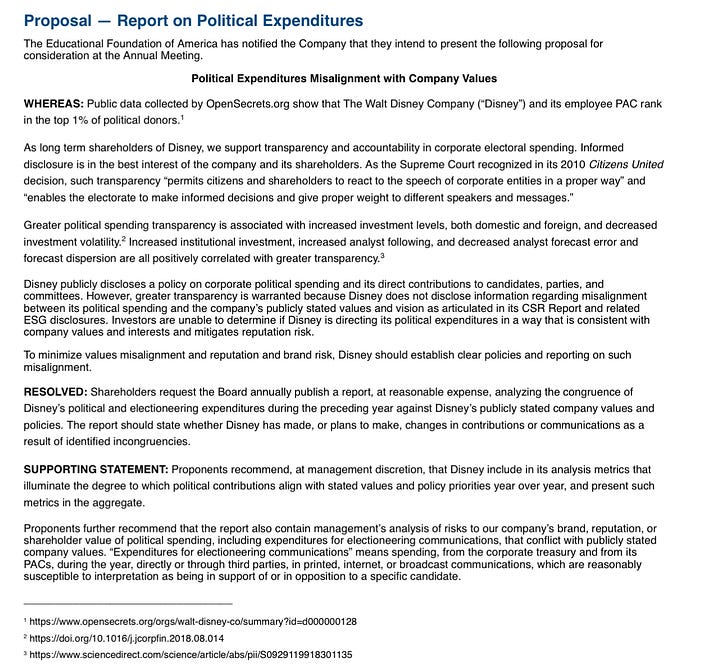

Shareholder Proposals: latter two filed by the proxy contest dissident parties

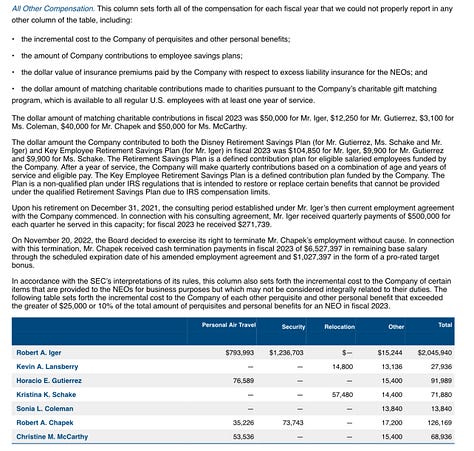

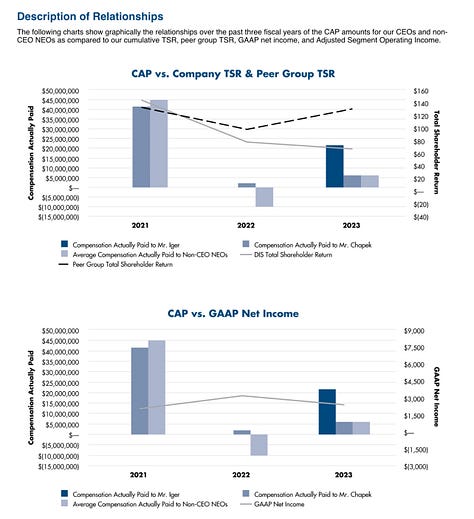

2023 Compensation:

Iger:

$31.6mn in total compensation

~$800k in personal air travel

~$1.2mn in security

**Disclaimer**

The information provided in this blog/email is for general informational purposes only. While I strive to ensure the accuracy and reliability of the content, I make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the blog or the information, products, services, or related graphics contained on the blog for any purpose. Any reliance you place on such information is therefore strictly at your own risk. All posts and opinions expressed on this blog are solely my own and do not reflect the opinions or views of my employer. The content shared here is a representation of my personal thoughts and insights on various topics, and should not be considered as professional advice or the official stance of any organization. Please use your discretion and consult with relevant experts before making any decisions based on the information provided on this blog/in this email.