Neuberger Berman’s Shareholder Proposal

Unconventional move by investment manager garners support from proxy advisers

$450bn investment manager Neuberger Berman has filed a shareholder proposal to eliminate the dual-class structure at Lions Gate Entertainment (LGF). As many of you know, such a move is rare for a large US-based manager.

The SHP requests the board “. . . take all reasonable and necessary steps to ensure that each outstanding share of common stock has one vote.”

In an equally unconventional move, the board has decided to offer no opinion on the matter, stating “[t]he Company appreciates the proposal and will continue to evaluate whether single or dual-class stock is the most appropriate share structure for executing its strategic initiatives.”

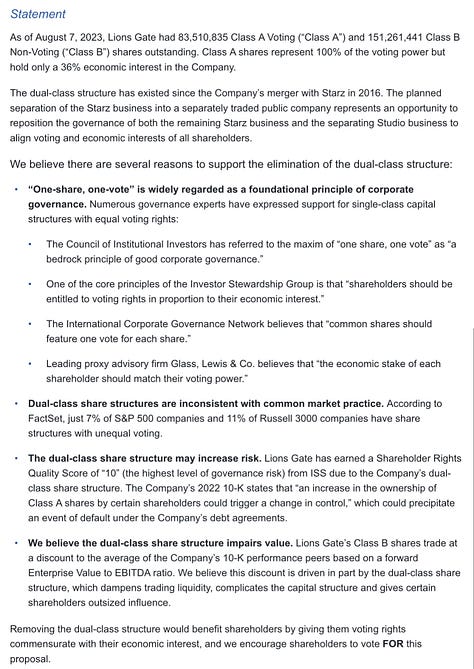

NB filed a solicitation in support of the proposal last month, writing: “Lions Gate’s dual-class structure has existed since the Company’s merger with Starz in 2016. Neuberger Berman strongly believes that the planned separation of the Starz business should be implemented in a manner that positions the company that will hold the remaining Starz business and the company that will hold the separating Studio business with governance structures that align the voting and economic interests of all shareholders.”

The solicitation mentions further that “. . . just 7% of S&P 500 companies [maintain] share structures with unequal voting.”

In a statement earlier today, NB disclosed that both ISS and Glass Lewis have recommended shareholders support the SHP.

The AGM will be held on November 28.

**Disclaimer**

The information provided in this blog/email is for general informational purposes only. While I strive to ensure the accuracy and reliability of the content, I make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the blog or the information, products, services, or related graphics contained on the blog for any purpose. Any reliance you place on such information is therefore strictly at your own risk. All posts and opinions expressed on this blog are solely my own and do not reflect the opinions or views of my employer. The content shared here is a representation of my personal thoughts and insights on various topics, and should not be considered as professional advice or the official stance of any organization. Please use your discretion and consult with relevant experts before making any decisions based on the information provided on this blog/in this email.